Award-winning PDF software

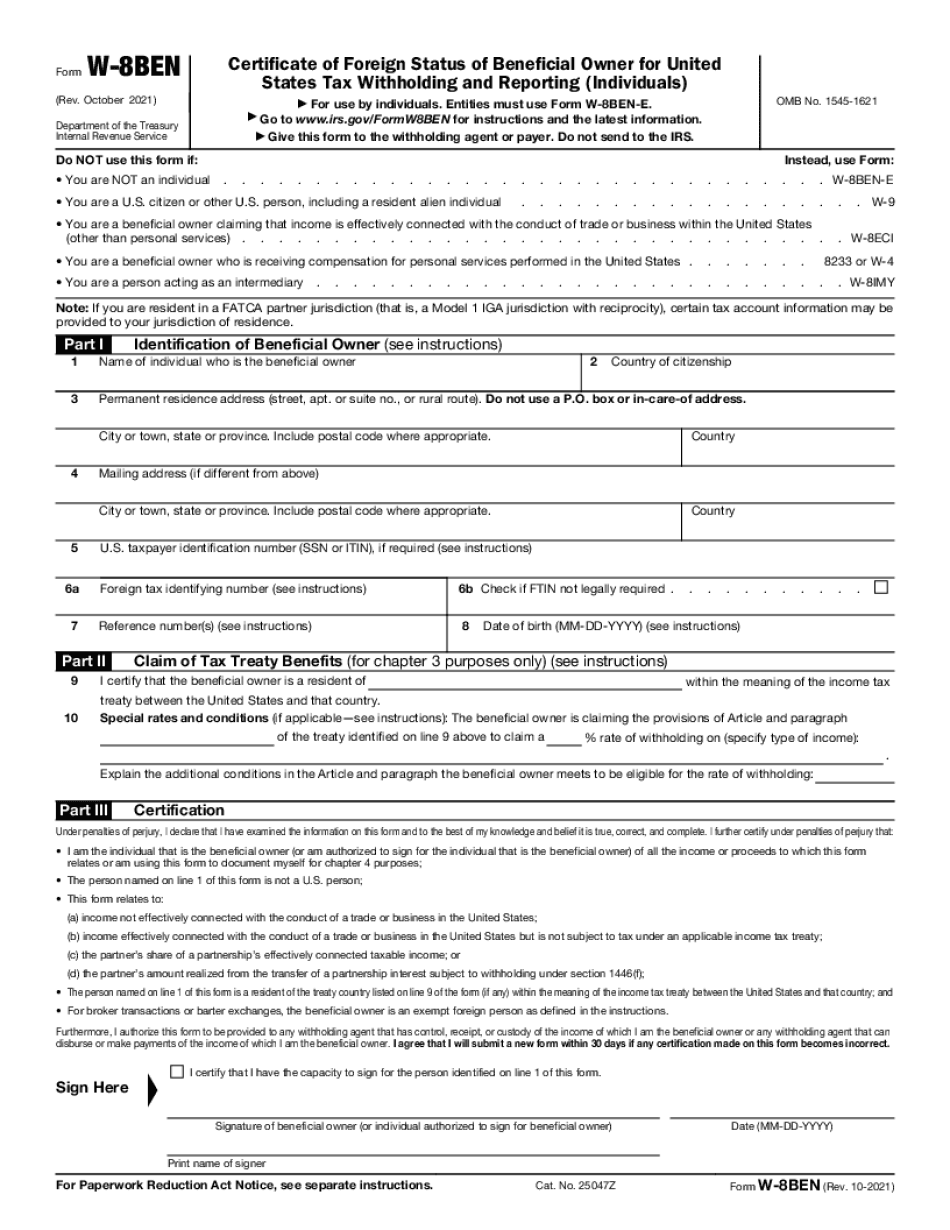

Form W-8BEN California San Bernardino: What You Should Know

If the payee is a nonresident alien, they are required to withhold 8.45% on payments to a foreign nonresident (subject to certain limitations), or 12.95% on payments to a resident alien. If you are a nonresident student or resident alien, your payee is not required to take nonresident withholding. SURF | FAQs.ca.gov Apr 13, 2025 — Your payee may take 10% from your CA income if all the following apply: You are an individual You are an individual resident of the United States who is age 18 or older The payment will be made to your employer You are a resident of Canada or Mexico You are a nonresident alien who is not a U.S. citizen or resident alien Your payee is a resident of Canada or Mexico This payment will be made to your employer Your payee is a nonresident alien who is not a U.S. citizen or resident alien (unless they received a student visa or extension of stay and are applying for Canadian citizenship or permanent resident). If you are a nonresident alien student, your payee You are not living within the United States (unless you are employed on a full-time basis) Your payment is for educational or scientific purposes Your payment is for an employer who requires a nonresident alien employee Your payment is for an employer who does not require a nonresident alien employee (or an employee of a nonresident alien) Your payment is for a nonresident alien who received a nonresident alien student visa Your payment is for an employer who requires a nonresident alien employee (or an employee of a nonresident alien) Your payment is for the direct payment of expenses Your payment is a reimbursement or subsidy for an expense incurred in the United States (including for a trip to the United States) You are under age 65, or you have a physical or mental impairment, and you do not fully recover Your payment is for an employer who provides medical or nursing service to nonresident aliens (in the case of nursing services) who live outside the United States Your payee, including nonresident aliens employed by a U.S. company, is an employer that is engaged in the business of exporting or importing products or services. Your payment is for a nonresident alien who is a student, and is required to receive the same U.S. health insurance coverage as a U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8BEN California San Bernardino, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8BEN California San Bernardino?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8BEN California San Bernardino aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8BEN California San Bernardino from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.