Award-winning PDF software

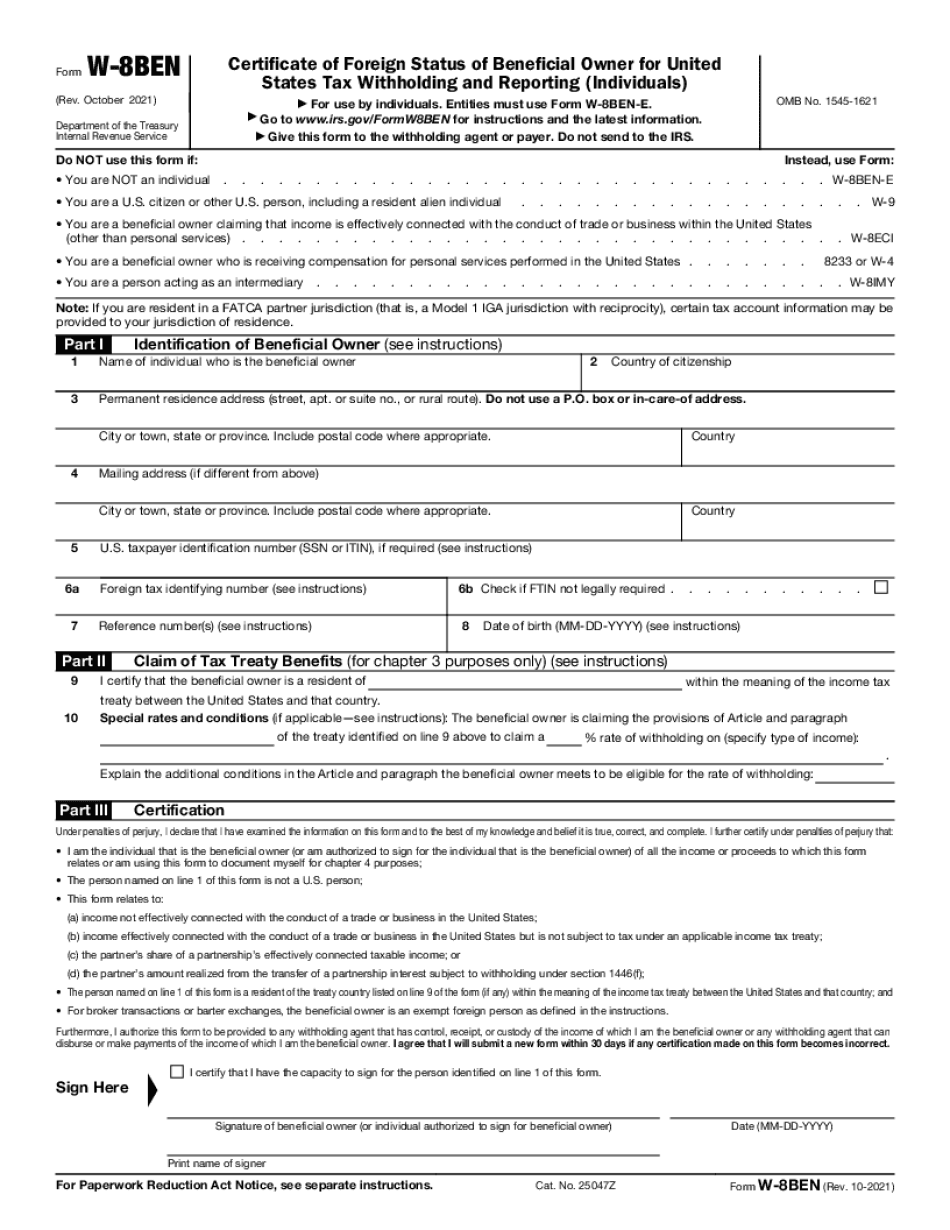

Printable Form W-8BEN Oxnard California: What You Should Know

NRA tax information collected from any individuals must be disclosed to the IRS for taxation, reporting, and other purposes, The amount of taxpayer information collected for all persons in the United States (including non-U.S. citizens) is governed by the authority of IRC Section 6101(a)(8). All information must be provided to the IRS by March 31 of the year following the calendar year for which information is to be reported; including information that you are no longer a taxpayer. Any information obtained from non-U.S. citizens that is not provided by March 1 of the year after the calendar year for which the information is to be disclosed can be used until the end of the calendar year for which the information may be disclosed. The information may be used only for the purpose of establishing your status with the IRS or a U.S. government agency or for the purpose of determining your claim for the earned income tax credit or the credit for child, dependent, and other support payments. Informing the IRS When in California: When you have notified the ATF of your residence and the federal government of your citizenship, you are required by law to provide the ATF with your California residency information in an ATF Form 8300. The ATF cannot process any transaction that includes information that is not provided by the time required. To find that date, check the box on the “California Required Addresses” page at the bottom of ATF Form 8300 This is the same address information that is recorded on ATF Form 4473. An ATF Form 8300 is required when you change your address or when you report any change of address within the United States. If you do not provide the ATF Form 8300 with the necessary California residency information, you will be assessed a 500 fee for each return or report required to be submitted, and you will be required to provide a copy of the Form 8300 if you are an S corporation or an individual. If you are on active duty, you must also inform the ATF that you are a California citizen. A California address is required if you are a United States citizen. If the information on the ATF Form 8300 does not match the information on IRS Form W-8BEN, you will be denied the right to purchase a firearm or ammo. There is much more information from the W-8BEN on the ATF website.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form W-8BEN Oxnard California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form W-8BEN Oxnard California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form W-8BEN Oxnard California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form W-8BEN Oxnard California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.