Award-winning PDF software

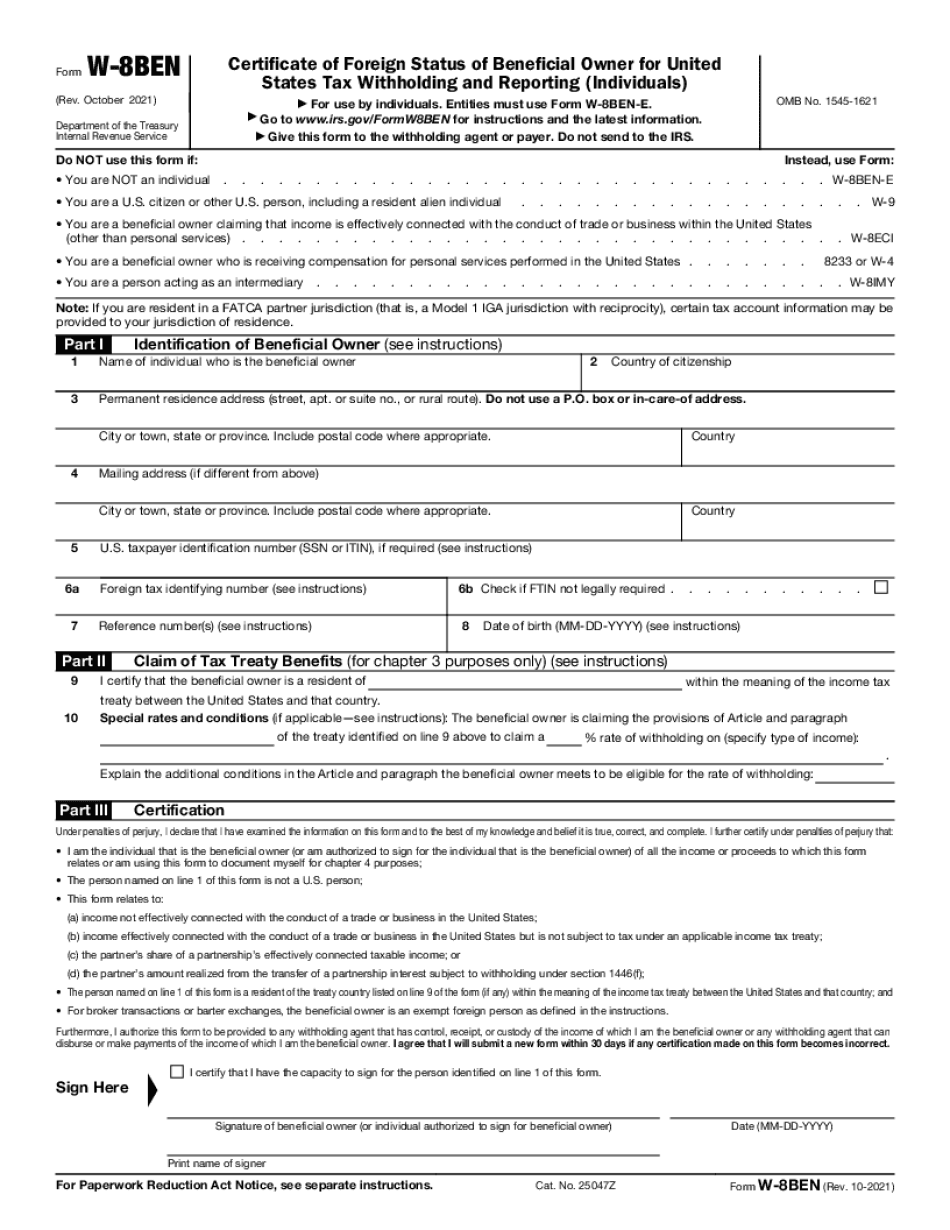

Joliet Illinois online Form W-8BEN: What You Should Know

We are located at the Joliet Public Library, at 2601 E. Maple, Suite 204, Joliet, Illinois 60516. Tax assistance is provided 24 hours a day, 7 days a week. Tax Help is available to individuals and families. We have staff that can help you on our phone or web line). Our staff is available Monday through Friday from 8:30 a.m. to 5 p.m. Illinois Department of Revenue website provides a list of the Taxpayer Advocate Service (TAS) offices and contact phone numbers. Illinois Department of Revenue telephone numbers • TAS office hours are 8:30 a.m.- 5:30 p.m., Monday through Friday • Taxpayer Advocacy Center, Toll Free, Illinois Department of Taxation Phone Numbers. Illinois Department of Revenue telephone numbers & web pages include a list of state agency websites. You can access this list by clicking the link below from the official Illinois Department of Revenue website. For assistance with personal income taxes, contact the state's Department of Revenue at or in writing at the address and toll-free number listed below. Illinois Office of State Taxation. State Sales & Use Tax. Illinois is unique in its status as state with one of the strictest and most complicated tax statutes in the industrialized world. We have two taxes: the General Sales and Use Tax and the Municipal Property Tax. The General Sales and Use Tax is the primary consumer sales tax and is applied at every point of purchasing. The Municipal Property Tax provides municipalities with revenues to meet basic responsibilities for general revenue. Municipal Property Taxes are assessed for the entire property tax base. The City of Chicago does have an optional “subterranean portion” tax on municipal properties, but the tax is applied at a lower rate. Illinois taxes are among the highest in the U.S. The rate is a flat 16.5% for both the General Sales and the Municipal Property Tax on both residential and non-residential taxpayers. The City of Chicago collects the Sales and Use Tax of 16.5% and the Department of Revenue levies it on non-residential property. For more information on how the tax works, please visit the Illinois Department of Revenue's website. For additional information, visit the Illinois State Department of Revenue website.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Joliet Illinois online Form W-8BEN, keep away from glitches and furnish it inside a timely method:

How to complete a Joliet Illinois online Form W-8BEN?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Joliet Illinois online Form W-8BEN aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Joliet Illinois online Form W-8BEN from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.