Award-winning PDF software

Form W-8BEN Lakewood Colorado: What You Should Know

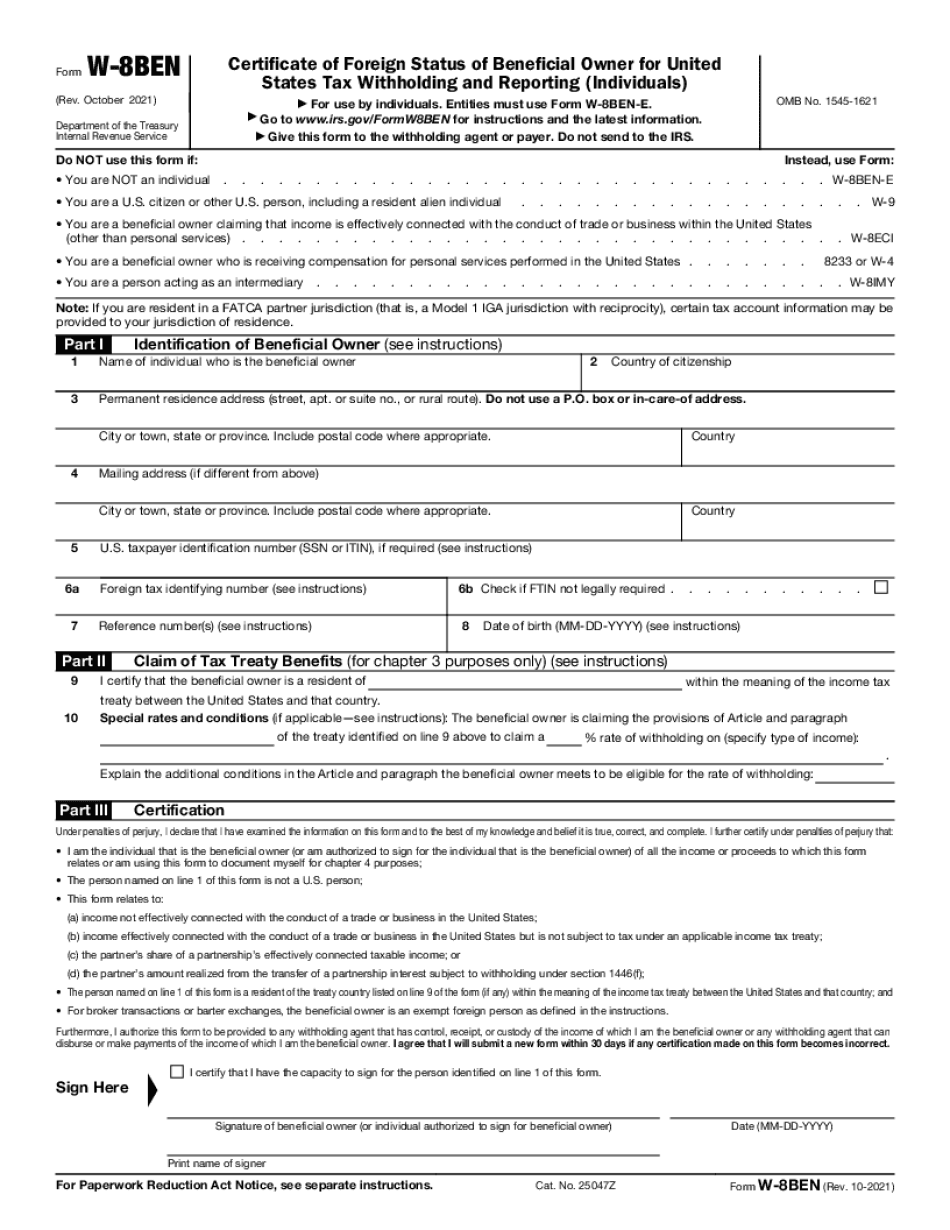

The university will withhold any tax due on the income from the tax-exempt entity to which you are a nonresident individual for the tax year such payment is made. The school will withhold tax on all amounts paid to you by the school, regardless of whether such amounts were actually received by you or a person with a tax relationship to you. Your nonresident alien status will be verified by the institution's foreign tax agent for all income tax withholding and credit purposes. However, the institution may request that the foreign tax agent do not verify your nonresident alien status. Taxpayers must complete and sign the form as part of the federal Filing and Certification System (FCS) Form 8822, if they are a nonresident alien or a foreign person who owns or pays a substantial amount of income by source to individuals who are not nonresident aliens, whether any or only a majority of the income is reported in the United States. Foreign financial reports must contain either: An actual signature of a “Qualified U.S. Source” or A declaration under penalty of perjury that the information is true and correct. It is important to remember this provision, especially if you plan to make distributions from your IRA or 401(k) to non-U.S. persons. This provision applies to IRA and 401(k) distributions. If you make a nondeductible contribution to a retirement plan, a nondeductible IRA distribution may require a check sent to the nonresident alien's home country without a U.S. taxpayer identification number when making an IRA deduction. Forms W-8 BEN, 1099-MISC, or BXC-20 must be completed only once if you have both a U.S. and a foreign financial reporting unit. The foreign financial reporting unit must identify this financial reporting unit from each of its financial records for all U.S. and foreign income tax purposes. This financial reporting unit may also be described as the financial account that received the U.S. financial disclosure. Form W-8BEN, Certificate of Foreign Status of — Federal agency required. Form W-8BEN-E, Certificate of Foreign Status of Persons who are Beneficiaries or Members of Certain Business Entities — The employer of any employee or independent contractor who files Form 1099-MISC with the IRS, must complete a Form W-8BEN-E.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-8BEN Lakewood Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-8BEN Lakewood Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-8BEN Lakewood Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-8BEN Lakewood Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.