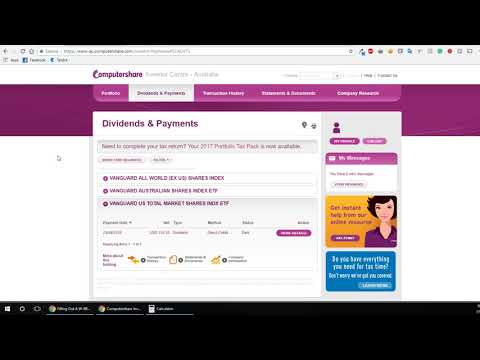

Hey guys, just thought I'd make a quick video to explain how to determine if your W-8 BEN E form is working. When you feel it, the W-8 BEN E form helps to avoid being taxed twice. If you hold ATF's or shares domiciled in the U.S., you'll have to pay Uncle Sam some tax. However, the W-8 BEN E form is meant to prevent double taxation due to the tax treaty between the United States and our country. This video aims to show and explain how to identify if the form is being applied correctly. Here's what you need to do: go to your register (mine is Computer Shares), log in to the Investor Center, and navigate to the dividends and payments section. I have three funds, including the U.S. Total Market Shares Index ETF with the code BTS, which we will examine. I also have the same with the VEU VA S, but you don't have to worry about it as it's domiciled in Australia. Recently, I received a dividend payout and I want to click on "more details" to delve deeper into the matter. When I click on "more details," I am directed to a screen where I can determine how the form is being applied. Here, you'll find the franked amount, which I believe is in USD currency, and the withholding tax amount. The withholding tax amount is crucial. To ensure that the form is working, you need to calculate the percentage of the withholding tax to the unranked amount. It should be 15%. If you haven't filled out the form, they will deduct 30% from you. However, with the form filled out and properly applied, the withholding tax should be 15%. There are additional details, such as the amount paid in AUD, but the focus is on...

Award-winning PDF software

Supplement to W 8ben nfc1048w Form: What You Should Know

Please include this information in Section J of Form W-8BEN on page 1. See Instructions for Form W-8 BEN—IRS Please fill out the required section on page 1 and attach it to your completed Form W-8 BEN. See Instructions for Form W-8 BEN and Payment Options Please complete and attach the form to your completed Form W-8BEN and submit it to the U.S. Treasury, and any taxing authority requesting the form. (See Instructions for Form W-8BEN and Payment Options) Please read my Privacy Policy if you want to see how we use this data. The Forms W-8 BEN and W-8BEN have been created for use by individuals or other organizations, both for use as a tax return, and in connection with the services performed for that individual. By using the Forms W-8 BEN and W-8 BEN services you indicate your agreement that we may contact you for additional information. This does not include a statement by you to the IRS indicating that you do not want us to contact you, or to send you a Form 1099-MISC in the form of a check. The following services are offered by the IRS, and are available during normal business hours: (a) We may ask if you have any special problems; (b) If you have any special problems, you'll be asked to call us, or provide a phone number. Once we call you, we may ask for a phone number or address in order to further verify whether you meet the requirements of the W-8BEN. If we obtain the information necessary to verify your W-8BEN, we will contact you by mail to confirm your address and phone number. We will then contact the U.S. Treasury concerning payment. If you answer all of our questions before you pay, the IRS is not required to make any additional determination whether you meet the requirements of the W-8BEN. If you do not meet the requirements of the W-8BEN, you must send us form W–8 BEN with the required information within three (3) days of a telephone request for certification. The form must include your name, account number (if you have one), and your SSN.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8BEN, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8BEN online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8BEN by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8BEN from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Supplement to Form W 8ben nfc1048w